Cardano's Proof of Stake (PoS) protocol stands out as a significant innovation within the blockchain space. Its unique liquid nature sets it apart from other blockchains, offering users the freedom to engage in staking while retaining the flexibility to move their ADA at any time for participation in a range of decentralized finance (DeFi) activities. This liquid feature, combined with the protocol's self-custodial nature, instills confidence in users, ensuring that their assets remain under their sole ownership without reliance on third-party control. Furthermore, despite its advanced functionality, Cardano's PoS mechanism is remarkably user-friendly, requiring only a few simple steps to participate. This streamlined approach not only reduces barriers to entry but also mitigates potential risks, making Cardano's PoS protocol accessible and secure for all.

Proof of Stake

To understand staking on Cardano, it's essential to grasp the fundamentals of Proof of Stake (PoS) consensus. In decentralized blockchains, where centralized control is absent, a decentralized method of validating transactions is necessary. PoS is one such method.

In PoS, individuals holding cryptocurrency have the opportunity to stake their coins, granting them the authority to validate new blocks of transactions and add them to the blockchain. This approach serves as an alternative to the original consensus mechanism known as Proof of Work (PoW). PoS has gained popularity due to its significantly lower energy requirements, positioning it as a more efficient and scalable solution for blockchain development.

When a block of transactions is ready for processing, the PoS protocol of the cryptocurrency selects a validator node—a participant responsible for verifying transactions on the blockchain—to evaluate the block's content. The validator node examines the accuracy of the transactions, and upon confirmation, the block is added to the blockchain. In return for their validation efforts, the validator node receives rewards in the form of the native cryptocurrency. These rewards are then distributed by the validator to their delegators, with the validator typically retaining a fee for their services.

Ouroboros Consensus Mechanism

In Cardano, the name "Ouroboros" refers to more than just the ancient mythological symbol of a serpent or dragon consuming its own tail. It is the consensus mechanism meticulously designed through peer-reviewed research and cryptography to determine which validator node adds the next block to the blockchain. Ouroboros serves a crucial role in upholding the network's security, sustainability, and functionality.

Time within Ouroboros is divided into epochs and slots. Each epoch spans a specific duration, typically lasting five days, during which a predetermined number of blocks are created. Within each epoch, slots represent shorter intervals where a block can be generated. The duration of a slot is fixed and determined by the network parameters. In every slot, a block leader is designated with the responsibility of adding a new block to the blockchain.

Cryptographic randomness plays a vital role in selecting the block leader for each slot. The selection process considers various factors, including the stake held by validator nodes in the network. In essence, the higher the amount of ADA staked, the greater the likelihood of being chosen. The block leader assumes the crucial role of verifying and validating the accuracy of transactions within each new block.

For users who do not wish to establish their own validator nodes and produce blocks, there is an option to delegate their stake to existing ones. These validator nodes are known as stake pools. By delegating their ADA to a stake pool, users can receive a share of the rewards distributed to the pool for its computational work. This delegation option significantly lowers barriers to entry, fostering greater decentralization of the blockchain.

The rewards obtained by slot leaders, stake pools, and delegators are sourced from emissions. These emissions serve as incentives for network participants, motivating them to contribute to the decentralization of the Cardano network and actively engage in its growth and sustainability.

Liquid Staking on Cardano

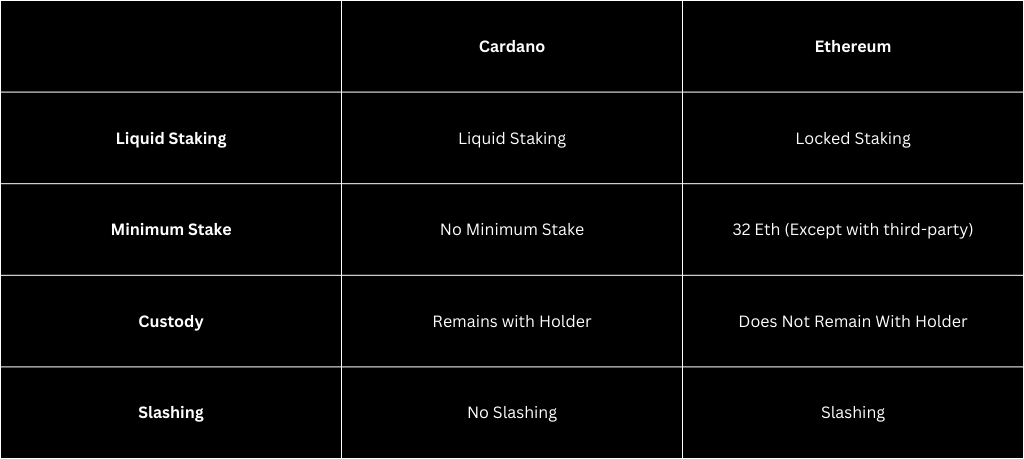

Cardano's Proof of Stake (PoS) protocol boasts a remarkable feature known as native liquid staking, setting it apart from other blockchains. Unlike traditional staking mechanisms that necessitate locking coins for extended periods, Cardano's PoS offers flexibility and safeguards against the risk of asset confiscation. Notably, there are no minimum requirements for staking, enabling users to participate regardless of the size of their holdings.

The introduction of liquid staking on Cardano allows users to stake their tokens while maintaining liquidity. This means that individuals can freely engage with decentralized finance (DeFi) platforms without sacrificing the opportunity cost associated with native staking on the network. By emphasizing these properties, Cardano aligns the interests of ADA holders with the goals of the blockchain, fostering a symbiotic relationship that promotes user engagement and network growth.

Slashing

One common aspect of the Proof of Stake (PoS) consensus mechanism employed by certain blockchains is the implementation of slashing. Slashing serves as a penalty mechanism designed to deter malicious behavior and punish validators who attempt to cheat the system. If a validator engages in dishonest actions, their staked coins are "slashed" or penalized, similar to receiving a traffic violation for validators. This mechanism aims to maintain order and discourage actions that are detrimental to the blockchain's best interests.

However, a significant drawback of implementing slashing is that it requires locking the staked coins, rendering them inaccessible for the duration of the staking period. To circumvent this limitation, individuals often rely on third-party services. Yet, this reliance on external entities contradicts the core principle of self-custody that underlies the ethos of blockchain and cryptocurrency.

This situation highlights a notable paradox. While slashing is intended to enhance security, the lack of liquidity resulting from locked coins compels people to depend on third-party and centralized services, introducing additional security risks in the process. This contradiction challenges the fundamental principles of decentralization and self-custody that are intrinsic to blockchain technology and cryptocurrency.

Cardano vs Ethereum PoS

Delegating your ADA

- • Get Cardano wallet that supports staking.

- • Transfer your ADA to that wallet from where you are currently storing it.

- • Find and delegate to a stake pool operator that works for your needs.

- • Your ADA is now being staked in the pool and will start earning rewards.

Conclusion

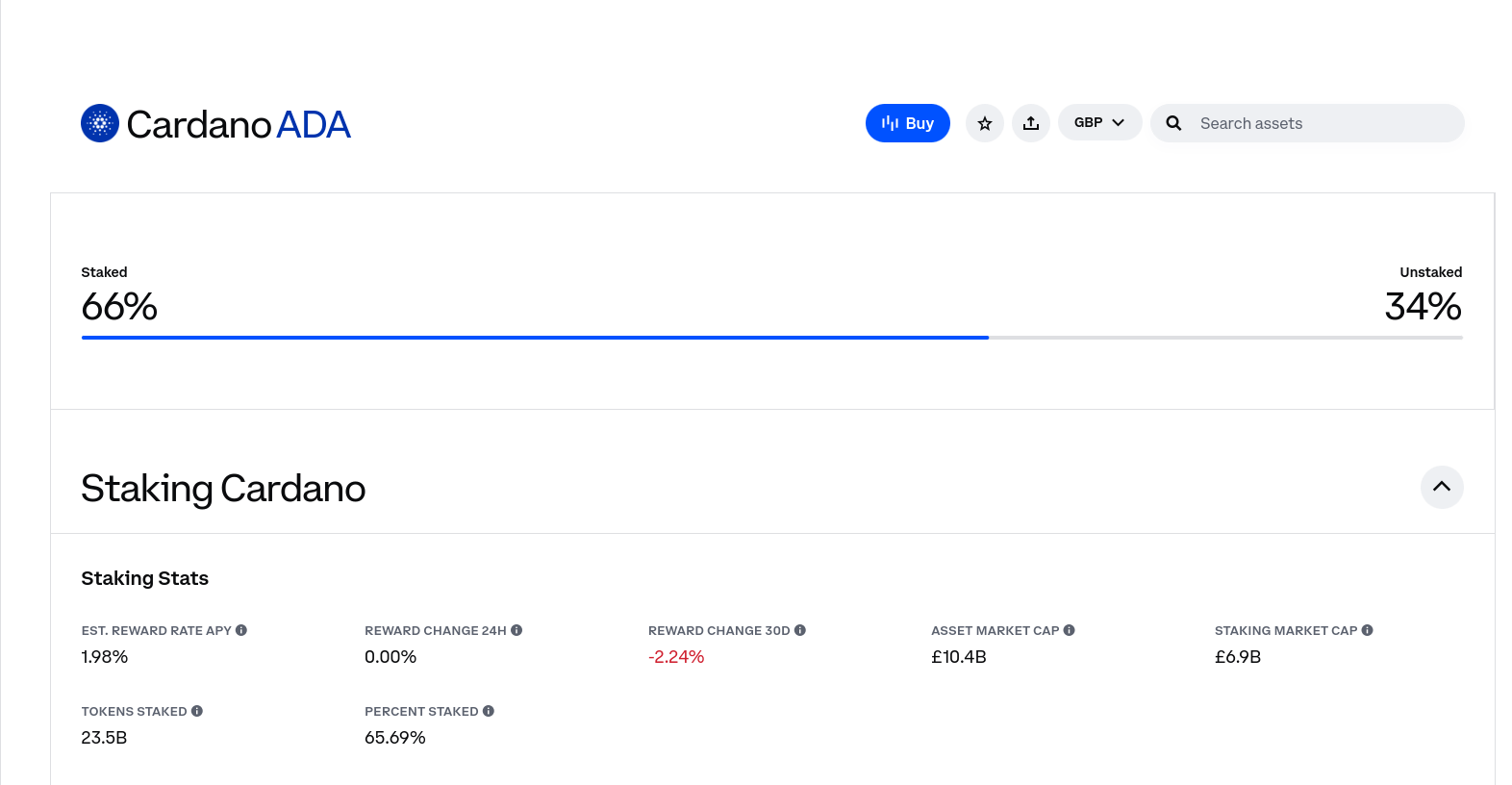

Cardano's Proof of Stake (PoS) protocol stands out as a secure, liquid, and user-friendly solution. These key attributes have contributed to an impressive staking rate of 66% of the circulating supply. Compared to other blockchains, Cardano offers an enhanced experience for both ADA holders and Stake Pool Operators.

The protocol's efficiency and reliability have ensured uninterrupted network operation for three years, eliminating any stoppages. This solid foundation has enabled Cardano to develop a robust and scalable decentralized finance (DeFi) infrastructure while maintaining the essential elements of security and decentralization.

By prioritizing these aspects, Cardano has created an ecosystem that accommodates the needs of ADA holders and facilitates the growth of Stake Pool Operators. This combination of features has propelled Cardano to become a leading platform, offering a superior experience and fostering the continued expansion of DeFi while upholding the principles of security, scalability, and decentralization.

Source: Coinbase - 18/06/2024