What are stablecoins?

Stablecoins are cryptocurrencies that are designed to have a stable value by being pegged to another asset, typically a traditional fiat currency like the US dollar. The purpose of stablecoins is to bridge the gap between real-world assets and digital assets on the blockchain. They aim to provide stability in a volatile cryptocurrency market, making transactions more practical and reducing the risks associated with price fluctuations.

These digital assets operate on blockchain technology, offering security, transparency, cost efficiency and speed. They combine the benefits of cryptocurrencies with the stability of traditional assets, such as the US dollar. This combination makes stablecoins valuable as they act as a bridge between the traditional financial system and the cryptocurrency economy.

One of the main use cases for stablecoins is facilitating cross-border payments, allowing for more efficient and convenient transactions compared to converting between cryptocurrencies and fiat currencies. Stablecoins also serve as a trading pair for more volatile tokens, providing a more stable base for trading activities.

Backed by specific assets or a basket of assets to maintain a stable value, stablecoins distinguishes themselves from other cryptocurrencies that lack asset backing and are therefore more prone to volatility. The backing assets are often fiat currencies, but stablecoins can also be pegged to other assets like precious metals or even other cryptocurrencies.

The benefits offered by stablecoins are mainly globality, privacy, low fees, and transparency. Due to their lack of volatility, there are many that consider it more suitable than traditional cryptocurrencies for various financial transactions and as a store of value.

Stablecoins are a response to the need for a stable digital asset that can be widely used for everyday transactions, international payments and as a hedging tool in volatile markets. By pegging their value to external assets, stablecoins provide stability and reliability in the cryptocurrency ecosystem.

Different types of stablecoins

Fiat-backed Stablecoins

Fiat-backed stablecoins, such as Tether’s USDT and Circle’s USDC are a type of stablecoin where the value is pegged to a traditional fiat currency, such as the US dollar, euro, or British pound by the backing of reserves. These reserves are usually held by a centralized entity, typically a company or a bank. The goal is to maintain a 1:1 ratio between the stablecoin and the fiat currency.

The centralized nature of fiat-backed stablecoins means that users have to trust the issuing entity to properly back up the stablecoins with real fiat currency reserves. Trust in the issuer’s regulatory compliance and ability to honour deposits and withdrawals is crucial. Some stablecoin issuers have faced challenges in demonstrating full 1:1 redemption capability, highlighting the importance of transparency and regular audits by third parties to ensure trustworthiness.

Fiat-backed stablecoins offer the advantage of stability, as fiat currencies are generally considered stable with low volatility. They provide a simple and straightforward structure, making them easier to understand and use.

However, there are disadvantages to fiat-backed stablecoins. The centralized structure leaves them vulnerable to hacks and bankruptcy risks associated with the custodian of the fiat reserves. There is also counterparty risk, as users must trust both the stablecoin issuer and the centralized entity holding the reserves. Additionally, these stablecoins are subject to the regulations and audits that come with fiat currencies, which can limit their efficiency and liquidity compared to regular cryptocurrencies.

Overall, while fiat-backed stablecoins offer stability, they come with certain risks and limitations related to centralization, trust, and regulatory compliance.

Crypto-backed Stablecoins

Crypto-backed stablecoins, such as DAI from the MakerDAO protocol on Ethereum, are a type of stablecoin that are backed by cryptocurrencies instead of traditional fiat currencies or other assets. These stablecoins are often operated by decentralized companies or organizations using smart contracts.

One key difference with crypto-backed stablecoins is that they typically employ overcollateralization. This means that the organizations holding the stablecoin reserves keep more cryptocurrency in their reserves than the amount of stablecoins in circulation. This overcollateralization helps to mitigate the volatility of cryptocurrencies and maintain the peg to stablecoins.

Crypto-backed stablecoins provide the benefits of decentralization, as they are based on blockchain technology. They also eliminate the need for a custodian, reducing counterparty risk. Additionally, crypto-backed stablecoins do not require the same level of regulations and audits as fiat-backed stablecoins.

However, there are disadvantages to crypto-backed stablecoins. The structure of these stablecoins is more complex compared to fiat-backed stablecoins. Additionally, the stability of crypto-backed stablecoins depends heavily on the collateralized cryptocurrencies, which can introduce a level of dependency and risk.

In summary, crypto-backed stablecoins offer a decentralized approach to stability by pegging their value to cryptocurrencies and utilizing overcollateralization. They provide benefits such as decentralization and reduced reliance on custodians, but they also come with the complexity of their structure and dependency on the collateralized cryptocurrencies.

Algorithmic Stablecoins

Algorithmic stablecoins, such as Terra Luna’s UST, can have varying approaches to reserve assets, but their main differentiating factor lies in their strategy to maintain a stable value by utilizing algorithms. These algorithms, essentially computer programs running predetermined formulas, control the supply of the stablecoin.

In certain aspects, this mechanism shares similarities with central banks, which also do not rely on reserve assets to stabilize the value of the currency they issue. Even in the case where there is reserve asset, such as UST, there can be a case of failure when the reserve asset loses value in such a short period of time.

These stablecoins rely on smart contracts and algorithm-generated mechanisms to manage supply and demand dynamically. By adjusting the supply of stablecoins in response to price fluctuations, they aim to stabilize the value of the token without the need for collateral.

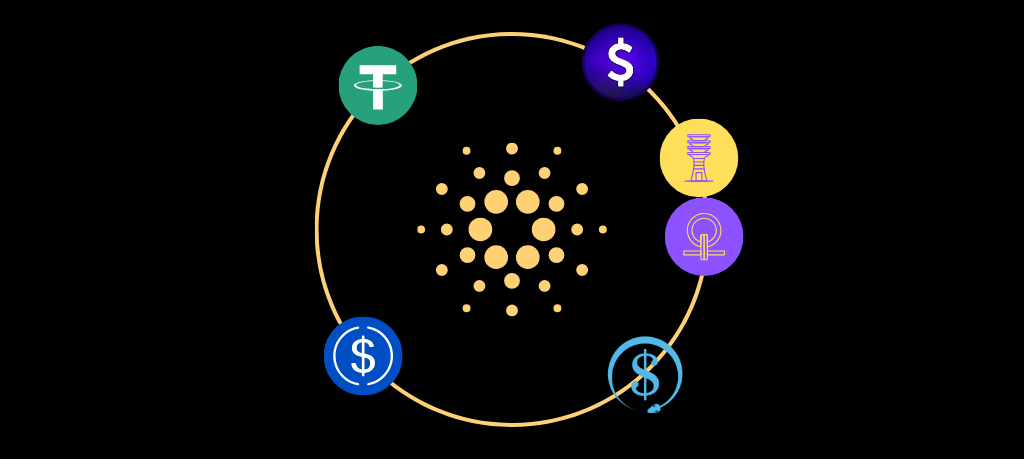

Stablecoins on Cardano

Throughout 2023, Cardano experienced growth in its Decentralised Finance (DeFi) ecosystem. This is evidenced by an increase in the metric known as total value locked (TVL). Stablecoin TVL specifically, driven by iUSD and DJED, rose in TVL by 36.8% as reported by Messari in their 'State of Cardano Q4' report. As further reported, this increased Cardanos ranking from 54th to 32nd compared to other networks.

Stablecoins play a crucial role in liquidity pools, borrowing and lending, leverage creation, and providing stability in the volatile crypto market. The Cardano ecosystem has seen the launch of various stablecoins, each with its own design and characteristics.

iUSD, developed by Indigo Labs, is a crypto-backed stablecoin that allows users to create synthetic assets pegged to the price of the underlying asset. iUSD’s stability relies on overcollateralization with ADA. The collateral ratio is set at 150% meaning a user needs at least $150 worth of ADA to mint $100 worth of iUSD. Indigo aims to achieve decentralization through open-source smart contracts and other measures.

Djed is another stablecoin on Cardano that is crypto-backed and overcollateralized. It was the first formally verified stablecoin in the ecosystem. Djed maintains its price stability through a smart contract that continuously controls the threshold amounts of stablecoins you can mint or burn. Users can mint Djed by providing $1 worth of collateral and can redeem it for $1. Djed sets a high collateral target of 400%-800%. It does this through a reserve currency called Shen, a representation of ownership of the reserve, SHEN also acts as a multiplier of ADA as well as gives its owners a share of the transaction fees accumulated from the protocol and staking rewards from the ADA in reserve. Despite its unique liquidation-free design, Djed has been largely unavailable to mint during a bear market.

USDM, developed by Mehen, is slated to be Cardano’s first native fiat-backed stablecoin. It aims to provide an alternative to fiat-backed stablecoins like USDC with enhanced transparency and security. Users can deposit dollars to Mehen and receive USDM coins in return. USDM will be a Cardano Native Asset without any blocklist. Fiat-backed stablecoins are highly stable and offer unlimited growth potential, but as mentioned earlier, they come with centralized risks, including regulatory and banking concerns.

The Cardano ecosystem has also benefited from bridges provided by Wanchain, which enable the availability of USDT and USDC stablecoins on Cardano. These bridges connect Cardano to other networks like Bitcoin, Ethereum and TRON, creating significant liquidity opportunities for Cardano’s DeFi sector.

Stablecoins in the Cardano ecosystem are still in their early days, with lower liquidity and volume compared to more mature ecosystems like Ethereum. However, the introduction of stablecoins like iUSD, DJED, and upcoming projects like USDM indicates the growing interest in stablecoin offerings on Cardano. The tradeoffs between different stablecoin designs, including decentralization, stability, and scalability, are key considerations for users and developers in the Cardano ecosystem.

Risks with Stablecoins

While stablecoins offer the benefits of fast and borderless transactions, low fees, and potential for financial inclusion, they also come with inherent risks which we need to be aware of as we become more and more reliant on this financial instrument.

Stablecoins can be vulnerable to runs similar to banks, where a sudden increase in redemption requests results in a fire sale of the assets backing the stablecoin. This can lead to further outflows as investors become concerned about the issuer’s ability to meet redemption requests. Incomplete regulation in the crypto ecosystem can magnify these risks.

Fraud and cyber risks due to the lack of transparency and complexity of the crypto ecosystem is another exposure that hovers over the stablecoin market. The involvement of third-party service providers and the lack of recourse for lost or stolen crypto-assets contribute to these risks. Incomplete regulation further compounds these operational risks.

In a doomsday scenario, a run on a stablecoin could trigger fire sales of reserve assets, causing dysfunction in funding markets, particularly during periods of market stress. This can have implications for broader market stability.

The stablecoin payment systems also have exposure to risk in the same way other payment systems, including credit, liquidity, operational, and settlement risks. The scale and nature of a stablecoin-based payment system can determine the extent of financial stability risks.

In summary, the risks with stablecoins include inadequate reserves, centralized issuance, regulatory risks, market and liquidity risks, operational risks, financial stability risks, increased bank exposure, disruptions to funding markets, and risks to the payment systems. While we do appreciate the role of stablecoins in cryptocurrency and its ability to bring in new users, we must also keep in mind what the whole point of cryptocurrencies is.

It is crucial to take a moment to pause and reflect on our intentions, especially within the Cardano community, in which the discussions of bringing more stablecoins into the ecosystem have become more prevalent. As we aim to offer an alternative to the existing banking system rather than replicating it on the blockchain. By adopting the mentality of bringing the traditional banking system onto the blockchain, we risk overlooking the risks that have historically caused catastrophic events such as the Wall Street crash of 1929 or the financial collapse of 2008. Our objective should remain aligned with Satoshi Nakamoto’s vision – with sound money to empower individuals with genuine financial freedom. It is essential to remember this core principle and ensure that our efforts contribute to the realization of this vision, rather than regressing back to the flawed systems we seek to replace.